Developing Land,

Growing Legacies

Got Land with development potential?

Find out what your land could be worth.

Got Land?

Find out What Your Land Could Be Worth.

Take Our 30 Second Quiz

OR

Call or Text OFFER1 to (623) 462-0703

Call us or Text OFFER1 to

(480) 771-0023

20+

Years Of Experience

23+

Major Markets - Operating In

Land development is like putting together a complicated puzzle. Our knowledgeable team of experts eliminate the unknowns and connect the pieces from contract negotiation through closing.

Our comprehensive knowledge and years of industry relationships streamline the process and gives each project the greatest assurance of success.

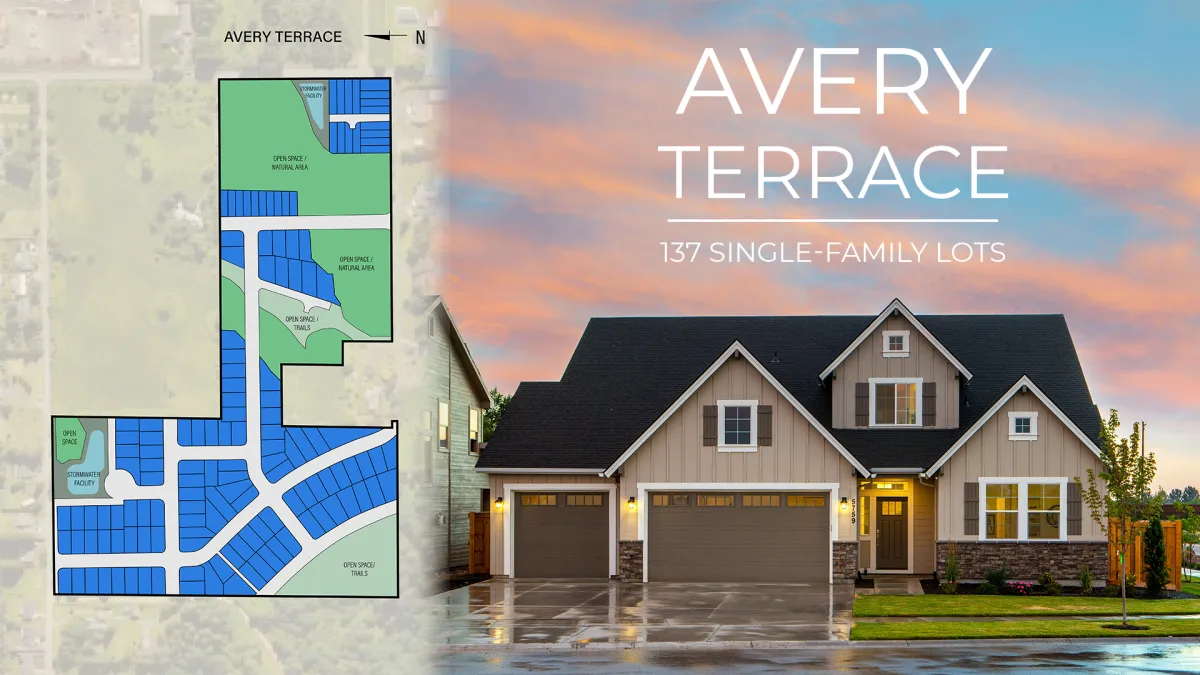

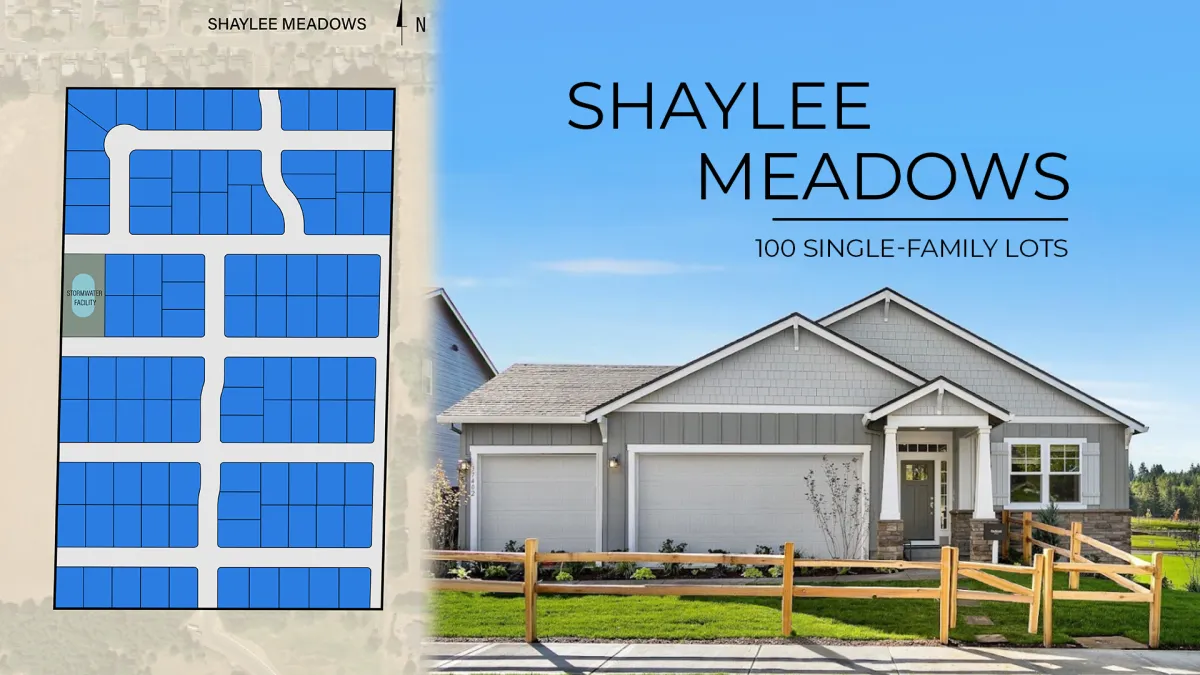

Our Projects

Explore some of our featured projects.

Why We're Different

Transparency - Innovation - Expertise

Transparency

We understand the importance of trust in the transaction. Selling large pieces of land is a big decision, which is why we walk through each step of the process in an efficient and informative manner.

We will not ask a landowner to sign a lengthy one-sided agreement; we will always be clear on expected timelines and project feasibility; we welcome external review of our contract by a landowner’s attorney or broker; and we never enter a contractual agreement that we do not have the financial ability to close.

Innovation

Grounded in rigorous research and powered by innovative technology, we can provide landowners a competitive and accurate valuation for their land.

Despite our wide geographic footprint, these advancements in data and technology paired with our seasoned team of experts, allow us to determine project practicality and pricing quickly and accurately at a highly localized level.

Expertise

Land development is like putting together a complicated puzzle. Our knowledgeable team of experts eliminate the unknowns and connect the pieces from contract negotiation through closing.

Our comprehensive knowledge and years of industry relationships streamline the process and gives each project the greatest assurance of success.

About Us

Who We Are

Allied Development is a national residential land developer focused on growing legacies. The mission of Allied Development is to grow the legacy of landowners, communities, and builders by developing land to create housing that allows families to flourish. We are America’s housing shortage solution, transforming raw land into vibrant communities across America. Originally founded in Oregon and now headquartered in Scottsdale, AZ, we leverage over 20 years of expertise to develop prime residential projects, ensuring maximum value for landowners, builders, and communities. We are innovators committed to transparency, value, and excellence.

20+

Yrs of Experience

20+

Years of Experience

What our property owners are saying

"I FOUND QUICK ANSWERS WHEN WE HAD QUESTIONS, AND WOULDN’T HESITATE TO WORK WITH THEM AGAIN."

"As a homeowner overtaken by the urban crawl, I had a lot questions regarding the timing of the development of a piece of property of which ours was a small portion. What we learned was that Allied Development has the respect of the title companies in their ability to come through as promised on all fronts. I found quick answers when we had questions, and wouldn’t hesitate to work with them again."

Bruce B. Property Owner

"KNOWING THAT THE LAND IS IN ALLIED’S HANDS HAS MADE FOR AN EASIER TRANSITION"

"Above all, I appreciate Cody’s character and integrity. I can’t express sincerely enough what a great experience it has been going through this with Cody. My business was not just a professional experience but really a large part of me and knowing that the land is in Allied’s hands has made for an easier transition. I greatly appreciate working with Cody and hope our paths cross again in the future."

Richard B. Property Owner

"EVERYTHING WAS FINISHED THEY HIT OUR CLOSING DATE ON THE NOSE"

"I worked with Allied on a property. Allied navigated us through the 8-month process, keeping us informed and prepared for what was ahead. From the beginning Allied was up front about the sale and when everything was finished they hit our closing date on the nose."

Dave D. Property Owner

"A SOLID COMPANY WHO COULD MAKE A COMMITMENT"

"Allied succeeded in developing my property where other developers failed. Their negotiating approach was low key and up front, which was a welcome relief from other prospective buyers. Throughout the negotiation process, other developers were represented by people who couldn’t make a commitment for their company. However, with Allied we always dealt with the people in a position to buy the property. In deciding on Allied, I knew they were a solid company who could make a commitment they could live up to and they did."